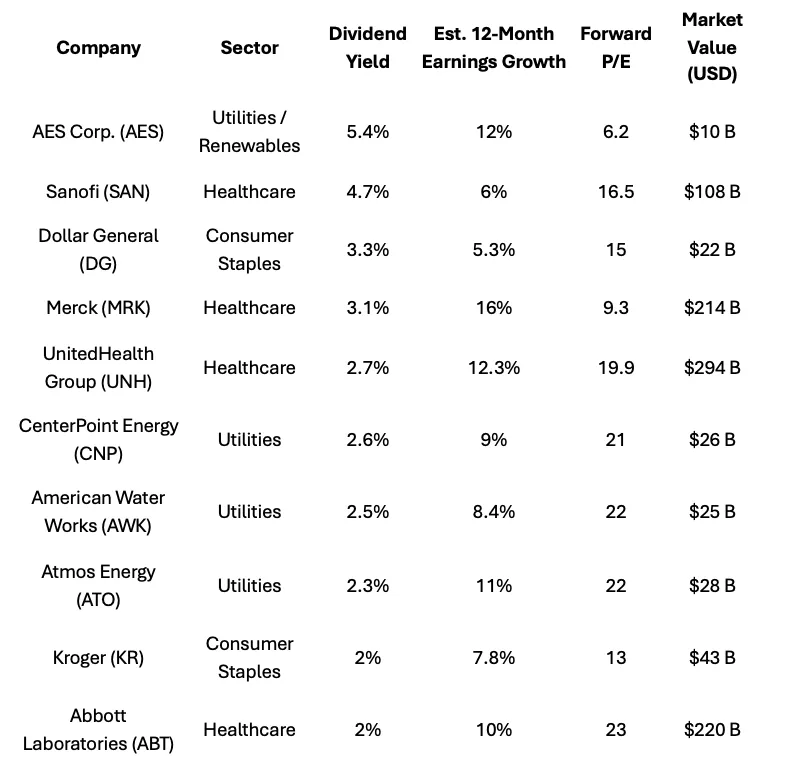

10 Defensive Stocks with Market-Beating Yields

As market volatility rises and investor sentiment cools, shifting toward defensive sectors may offer stability — and attractive returns.

After a strong year for equities, recent turbulence has reminded investors that bull markets rarely move in straight lines. Over the past week, the S&P 500 slid about 1.6%, marking its sharpest weekly drop in more than a month. The tech-heavy Nasdaq Composite fared worse, tumbling 3% — its steepest decline since April — as concerns mounted over overheated valuations and fading momentum in growth stocks.

Adding to the unease, a wave of corporate layoffs and weaker consumer sentiment data have cast doubt on the resilience of U.S. economic growth. Against this backdrop, investors are re-evaluating portfolio risk and seeking companies with reliable earnings, sustainable dividends, and steady demand — qualities typically found in defensive sectors such as consumer staples, utilities, and healthcare.

###How the Screen Was Built

To identify resilient opportunities, we are using FactSet data, screened for large-cap companies across defensive industries that combine earnings growth, dividend income, and financial discipline.

- Earnings growth: Analysts expect at least 5% operating-profit growth over the next 12 months — slower than the overall market but comfortably above inflation, signaling underlying strength.

- Dividends: All selected companies yield above the S&P 500’s modest 1%, with many offering double that.

- Payout ratio: Dividends consume no more than 60% of net income, ensuring that distributions are sustainable even in a downturn.

Top Picks: Stability with Yield

Leading the list is AES Corp. (AES), a renewable-energy producer offering a 5.4% yield and 12% expected earnings growth. Despite headwinds from U.S. policy shifts on clean-energy credits — and takeover speculation that AES declined to address — the company’s valuation looks compelling, trading at just 6.2 times forward earnings.

Other strong contenders include discount retailer Dollar General (DG) and grocer Kroger (KR), both of which tend to outperform when consumers tighten budgets. In healthcare, Merck (MRK) and Abbott Laboratories (ABT) stand out for combining consistent dividend growth with solid profit expansion of 16% and 10%, respectively.

Utilities — long favored for their predictability — also feature prominently, with CenterPoint Energy (CNP), American Water Works (AWK), and Atmos Energy (ATO) all offering stable earnings growth between 8–11% and dependable yields around 2.5%.

Rounding out the list, Sanofi (SAN) and UnitedHealth Group (UNH) provide exposure to healthcare services with high dividend yields.

Source: FactSet

Source: FactSet

Investor Takeaways

Periods of heightened volatility often remind investors of the importance of balance. While growth stocks may lead during expansions, defensive companies with healthy dividends and strong cash flows can provide critical ballast when sentiment turns cautious. With yields far above the S&P 500 average and consistent earnings momentum, the names on this list offer investors both income resilience and downside protection. In the months ahead, as macro uncertainty persists and rates remain elevated, leaning toward quality and defense may prove the most strategic way to preserve gains from the market’s earlier rally.